What is Position Trading?

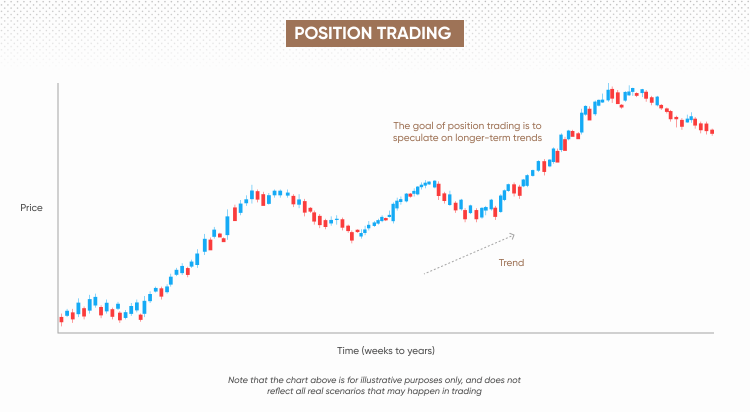

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. Instead of reacting to short-term fluctuations, position traders focus on capturing major market trends. While it shares similarities with investing, the key difference is that position traders can go both long and short, whereas traditional investors generally only buy and hold.

Among all trading approaches, position trading involves the longest time horizon.

Its advantages include reduced market noise, fewer trades to manage, and the potential to capture larger, more sustained market moves.

Highlights

Involves holding trades for months or years

Similar to investing but allows short selling

Applicable across forex, stocks, indices, commodities, and crypto

Position Trading vs. Other Strategies

| Position trading | Day trading | Swing trading |

|---|---|---|

| Time frame Long-term |

Time frame Short-term |

Time frame Medium-term |

| Holding period Months to years |

Holding period Within a day |

Holding period Days to weeks |

Day trading focuses on intraday opportunities, with positions opened and closed in the same day, requiring higher attention and capital for smaller but frequent gains.

Swing trading, by contrast, aims to profit from moves over several days or weeks, filling the gap between day trading and position trading. Position trading takes over where swing trading leaves off, targeting larger trends and longer horizons.

Want to improve your trading mindset?

Talk to an expert at Imperial Strategies today and start mastering your trading psychology.

Why Choose Position Trading?

Reduced frequency of trades – Less market monitoring, allowing more flexibility.

Long-term profit opportunities – Capturing broader market moves with potentially higher returns.

Lower transaction costs – Fewer entries and exits compared to short-term trading.

Risks of Position Trading

Market risk – Long exposure to unpredictable changes in market conditions.

Opportunity cost – Capital tied up for longer may miss short-term opportunities.

Margin requirements – Longer positions may require higher capital commitments.

Tools & Techniques

Technical Analysis – Indicators such as moving averages, RSI, and trendlines to identify entry and exit points.

Fundamental Analysis – Macroeconomic data, company earnings, and geopolitical trends to assess long-term value.

Risk Management – Stop-loss and take-profit orders, as well as carefully planned risk-to-reward ratios.

Building a Position Trading Plan

Select markets or instruments – Decide between forex, stocks, indices, commodities, or crypto.

Combine technical and fundamental analysis – Strengthen decision-making with both data sets.

Define entry and exit rules – Identify clear points to buy, sell, or exit.

Prepare for reversals – Stay cautious of trend changes that may disrupt long-term positions.

Key Factors for Success

Long-term outlook – A strong grasp of macroeconomic trends.

Patience – Willingness to hold through volatility.

Position sizing – Manage trade sizes carefully to balance risk and opportunity.

Want to improve your trading mindset?

Talk to an expert at Imperial Strategies today and start mastering your trading psychology.