strategy

5Min - Moving Average Crossover strategy

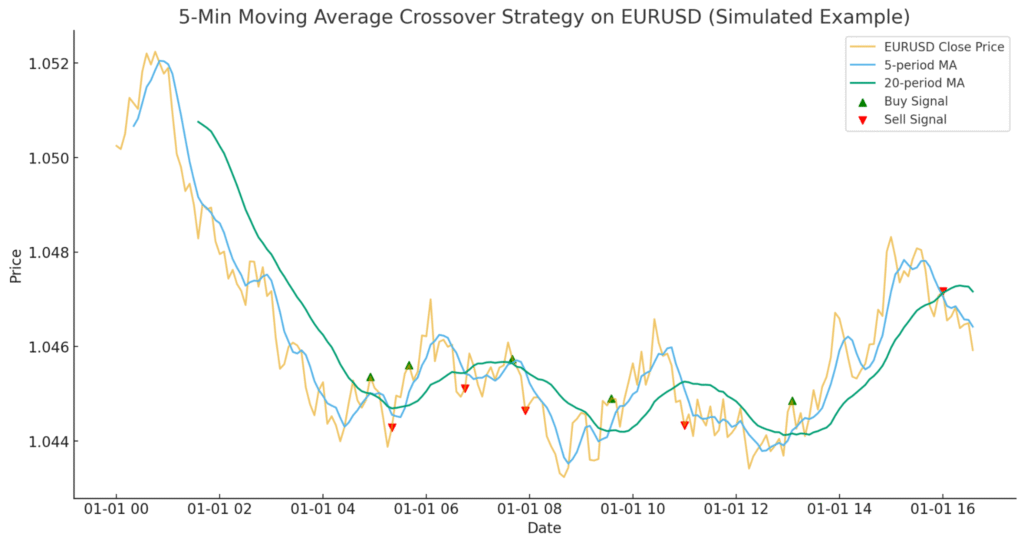

Here’s a detailed 5-minute moving average crossover strategy for Forex trading, using EUR/USD as an example. I’ve generated simulated 5-minute data to demonstrate the setup with charts and signals.

Strategy Rules

- Indicators

- Fast MA (5-period) → reacts quickly to price changes.

- Slow MA (20-period) → smooths out noise and defines the trend.

- Fast MA (5-period) → reacts quickly to price changes.

- Entry Rules

- Buy (Long Entry): When the fast MA crosses above the slow MA.

- Sell (Short Entry): When the fast MA crosses below the slow MA.

- Buy (Long Entry): When the fast MA crosses above the slow MA.

- Exit Rules

- Stop Loss (SL): ~15 pips away from entry.

- Take Profit (TP): ~30 pips away from entry (2:1 reward-to-risk ratio).

- Optional: Exit when an opposite crossover occurs.

- Stop Loss (SL): ~15 pips away from entry.

Example Trade Signals (EUR/USD, simulated 5-min data)

Time | Close Price | MA_Fast | MA_Slow | Signal |

2023-01-01 04:55:00 | 1.04536 | 1.04502 | 1.04501 | Buy |

2023-01-01 05:20:00 | 1.04428 | 1.04456 | 1.04469 | Sell |

2023-01-01 05:40:00 | 1.04561 | 1.04504 | 1.04476 | Buy |

2023-01-01 06:45:00 | 1.04512 | 1.04543 | 1.04544 | Sell |

2023-01-01 07:40:00 | 1.04574 | 1.04566 | 1.04564 | Buy |

Chart Example

The chart shows:

- EUR/USD closing price (candles/line).

- 5-period MA (blue) and 20-period MA (orange).

- Green arrows = Buy signals, Red arrows = Sell signals.

You can clearly see where crossovers occur, generating trade opportunities.

Key Notes

- Works best in trending markets (avoid sideways chop).

- Use risk management: no more than 1–2% account risk per trade.

- Can be combined with other filters (RSI, support/resistance, session times).

- SL/TP can be adjusted depending on volatility (e.g., ATR-based).

Want to improve your trading mindset?

Talk to an expert at Imperial Strategies today and start mastering your trading psychology.